Low Down Payment Mortgage Loans

Now Offering Two Loan Down Payment Options

- 10% Low Down Payment Mortgage

Maximum loan-to-value to 90% on the purchase of owner-occupied homes - 5% Low Down Payment Mortgage Loan

Maximum loan-to-value to 95% on the purchase of owner-occupied homes

Fixed Rate / Fixed Payment for the Life of Your Loan

Due to the power of local decision-making, the fixed rates you’ll find on Huntington Federal Savings Bank’s Low Down Payment Purchase Mortgages are among the most competitive that you will find in the market. Call one of our lending officers for current rates.

No PMI

To benefit our customers, we offer our Low Down Payment Purchase Mortgages without requiring the Private Mortgage Insurance (PMI) that most other banks charge for mortgage loans with less than 20% down.

Local Then. Local Now.

On top of all of that, there’s exceptional service and the fact that we never sell our loans on the secondary market. Your mortgage loan will stay right here at Huntington Federal for the life of the loan.

TO APPLY, CALL A MORTGAGE SPECIALIST 304-528-6230

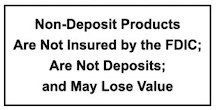

Rates, terms and conditions are subject to change. All loans are subject to credit approval. Contact Huntington Federal Savings Bank for specific eligibility requirements and guidelines. Member FDIC. Equal Housing Lender.

You are also welcome to send us a message via this contact form, and one of our bankers will be in touch with you soon.